TAX DOCUMENTS CHECKLIST

Know what you need to file taxes with our tax prep checklist

Feel prepared for your taxes. Use the H&R Block tax prep checklist or create your own by answering a few quick questions.

Small business owner?

Block Advisors can help you get things in order before you file.

Got your tax docs ready? Upload them in MyBlock!

Securely upload docs, schedule appointments, and connect with your tax pro year-round — all in one app!

File the way you want with H&R Block

Pull up a chair in our office or stay put on your couch. Any way you file, you’ll always get your max refund. Guaranteed.

Approximately 55% of filers qualify for H&R Block Online Free Edition. Simple tax situations only (Form 1040 and no schedules except Earned Income Tax Credit, Child Tax Credit, Student Loan Interest, and Retirement Plan Distributions). Learn more

- File yourself online any time, on any device

- Self-paced tax prep for simple returns

- Easy doc upload from phone, computer, or tablet

- File yourself online with live expert help

- Complex tax situations

- Options for deductions, investors, & self-employed

At home, in office, or drop off

- Online, in person, and hybrid options

- Expert support for unique tax situations

- Request to work with the same pro or get a new one

Putting 70 years of tax knowledge to work for you

SMART TAX REFUND

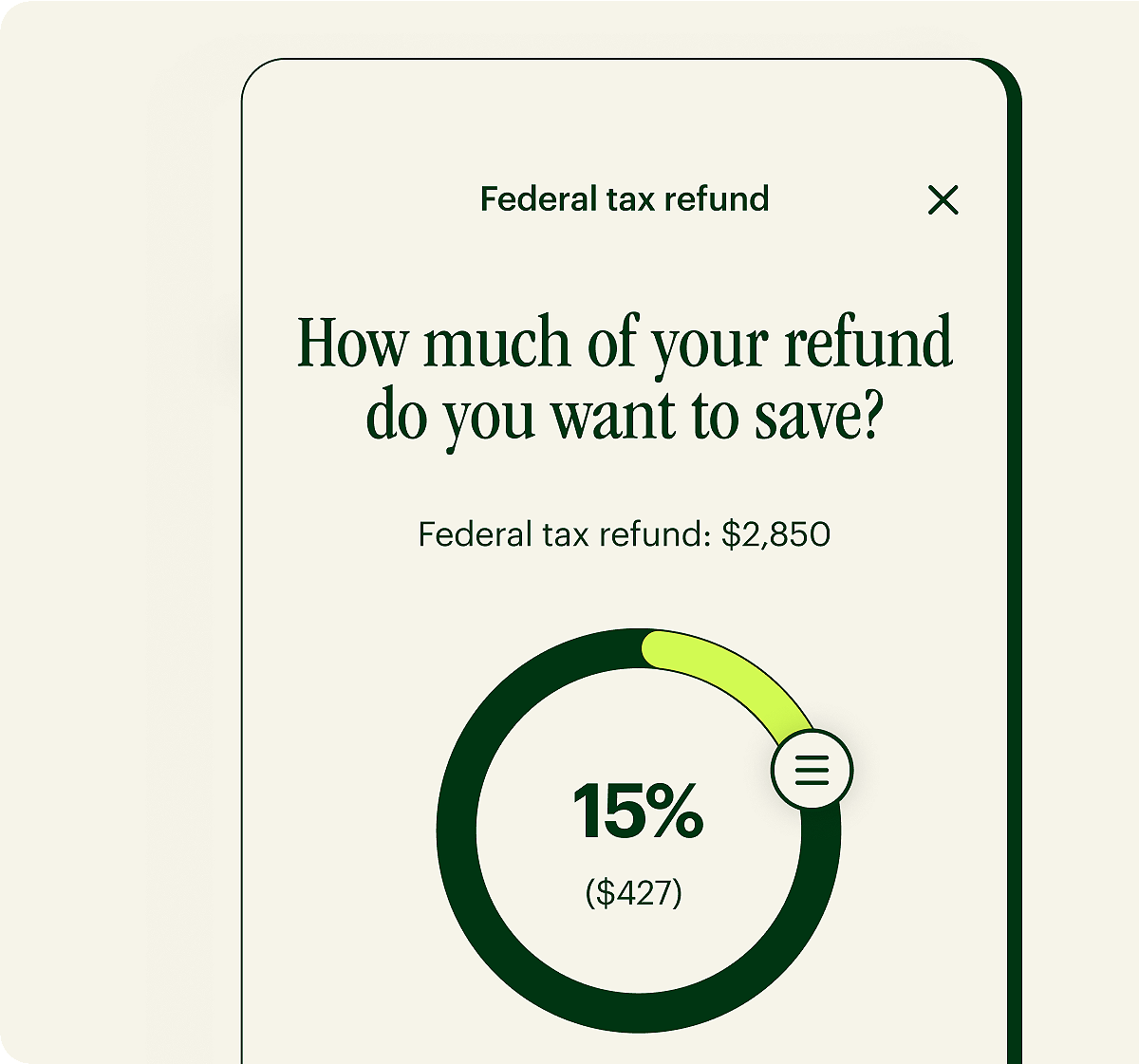

A personalized savings tool for your refund

The Spruce mobile banking app could help you make the most of your tax refund by recommending a portion to save when you get it. The amount you save earns high-yield interest after you opt in.

Approximately 55% of filers qualify for H&R Block Online Free Edition. Below are the specific tax situations that are included and not included in Free Online:

Included Tax Situations

W-2 Income: Income reported on Form W-2 employment

Interest and Dividend Income: Limited interest and dividend income reported on Form 1099-INT or Form 1099-DIV up to $1,500.

Standard Deduction: Taxpayers who take the standard deduction instead of itemizing deductions.

Earned Income Tax Credit (EITC): Eligibility for the Earned Income Tax Credit.

Child Tax Credit (CTC): Eligibility for the Child Tax Credit.

Unemployment Income: Unemployment compensation reported on Form 1099-G.

Student Loan Interest Deduction: Deduction for student loan interest paid.

Retirement Plan Distributions: Taxable qualified retirement plan distributions reported on Form 1099-R.

Excluded Tax Situations

Itemized Deductions: Taxpayers who choose to itemize deductions (e.g., mortgage interest, charitable contributions).

Self-Employment Income: Income from self-employment or freelance work reported on Schedule C.

Rental Income: Income from rental properties reported on Schedule E.

Capital Gains and Losses: Transactions involving the sale of stocks, bonds, or other capital assets.

Business Income and Expenses: Income and expenses from a business or farm.

Foreign Income: Income earned outside the United States.

Health Savings Accounts (HSAs): Contributions to or distributions from Health Savings Accounts.

Other Complex Tax Situations: Any other tax situations that require additional forms or schedules not supported by H&R Block Online Free Edition.

Spruce fintech platform is built by H&R Block, which is not a bank. Spruce℠ Spending and Savings Accounts established at, and debit card issued by, Pathward®, N.A., Member FDIC, pursuant to license by Mastercard®. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.