Small business owner?

Block Advisors can help you get things in order before you file.

- File yourself online any time, on any device

- Self-paced tax prep for simple returns

- Easy doc upload from phone, computer, or tablet

- File yourself online with live expert help

- Complex tax situations

- Options for deductions, investors, & self-employed

At home, in office, or drop off

- Online, in person, and hybrid options

- Expert support for unique tax situations

- Request to work with the same pro or get a new one

Putting 70 years of tax knowledge to work for you

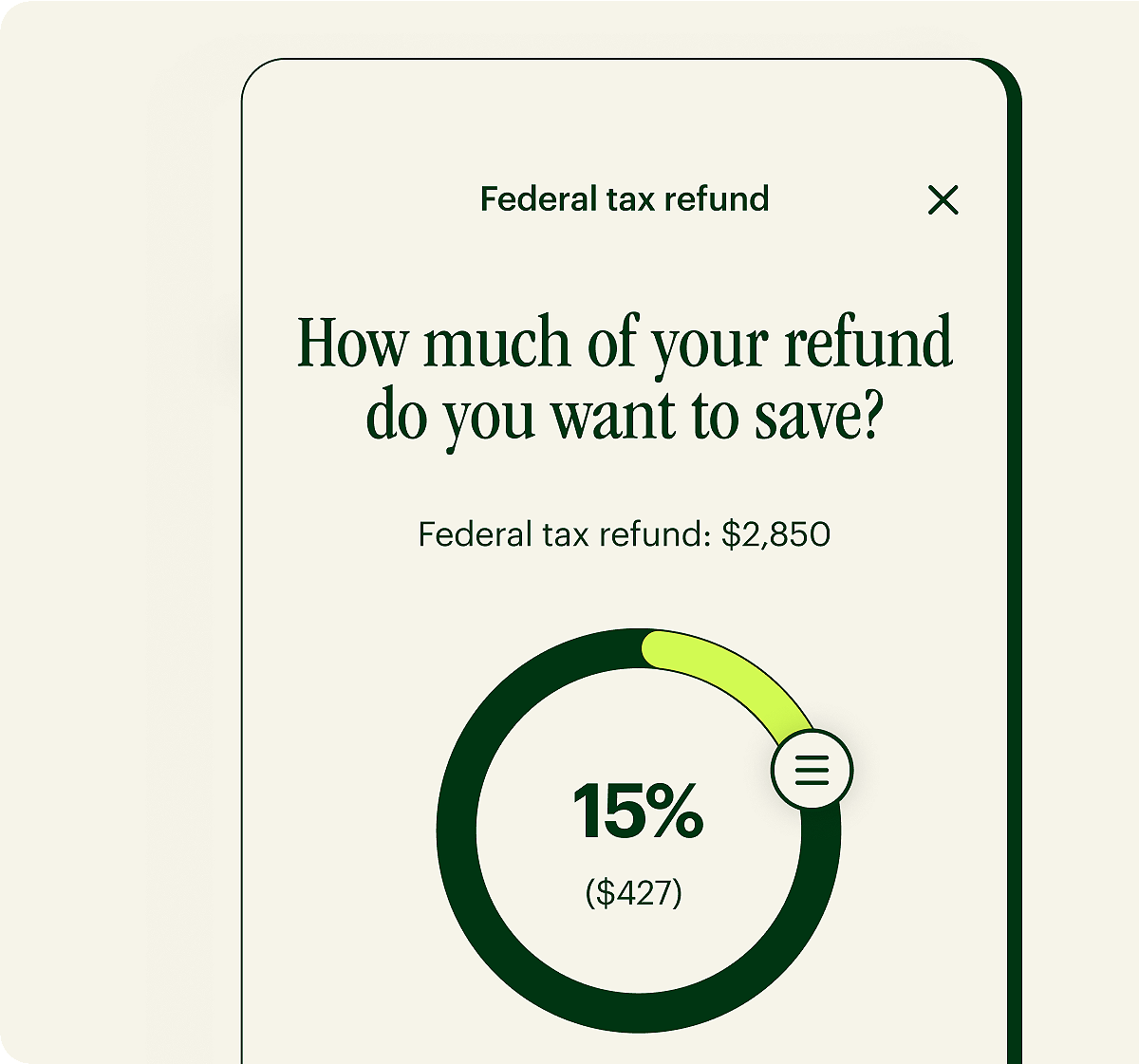

SMART TAX REFUND

A personalized savings tool for your refund

The Spruce mobile banking app could help you make the most of your tax refund by recommending a portion to save when you get it. The amount you save earns high-yield interest after you opt in.

Approximately 55% of filers qualify for H&R Block Online Free Edition. Below are the specific tax situations that are included and not included in Free Online:

Included Tax Situations

W-2 Income: Income reported on Form W-2 employment

Interest and Dividend Income: Limited interest and dividend income reported on Form 1099-INT or Form 1099-DIV up to $1,500.

Standard Deduction: Taxpayers who take the standard deduction instead of itemizing deductions.

Earned Income Tax Credit (EITC): Eligibility for the Earned Income Tax Credit.

Child Tax Credit (CTC): Eligibility for the Child Tax Credit.

Unemployment Income: Unemployment compensation reported on Form 1099-G.

Student Loan Interest Deduction: Deduction for student loan interest paid.

Retirement Plan Distributions: Taxable qualified retirement plan distributions reported on Form 1099-R.

Excluded Tax Situations

Itemized Deductions: Taxpayers who choose to itemize deductions (e.g., mortgage interest, charitable contributions).

Self-Employment Income: Income from self-employment or freelance work reported on Schedule C.

Rental Income: Income from rental properties reported on Schedule E.

Capital Gains and Losses: Transactions involving the sale of stocks, bonds, or other capital assets.

Business Income and Expenses: Income and expenses from a business or farm.

Foreign Income: Income earned outside the United States.

Health Savings Accounts (HSAs): Contributions to or distributions from Health Savings Accounts.

Other Complex Tax Situations: Any other tax situations that require additional forms or schedules not supported by H&R Block Online Free Edition.

Spruce fintech platform is built by H&R Block, which is not a bank. Spruce℠ Spending and Savings Accounts established at, and debit card issued by, Pathward®, N.A., Member FDIC, pursuant to license by Mastercard®. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.